To assist customers in reducing execution risk, IB supports guaranteed VWAPs for large cap stocks. The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock ("price" x "number of shares traded") and dividing the total shares traded.

Best-efforts VWAP is offered at IB's standard stock rate. See the fees page for Guaranteed VWAP rates.

A VWAP is computed from a beginning cut-off time to an ending cut-off time, and is calculated by volume weighting all transactions during this time period. VWAP prices are computed by Bloomberg, displayed after market close, and are guaranteed to be executed.

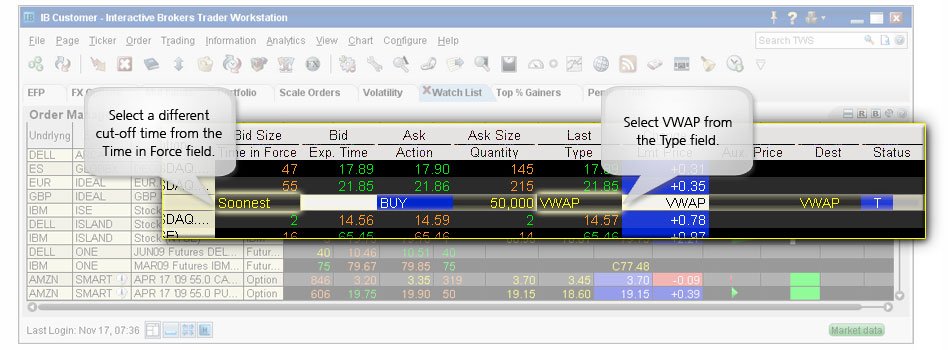

By default, beginning cut-off times are every minute from market open to market close. TWS will automatically submit your VWAP order for the next minute cut-off unless you elect a different beginning cut-off time by clicking the Time in Force field and using the clock feature to select a new time. You can also modify the ending cut-off time of the calculation (which is the close of the market by default) by using the clock feature in the Exp. Time field.

NOTE: If you elect to specify a start and end time, TWS confirms the validity of the order by checking that the prior trading day's trading volume for the specified time period is equal to or greater than that same day's volume for the last thirty minutes of trading. If it is less, TWS will add subsequent 30-minute interval trading volume amounts to the volume of the insufficient time period until the minimum valid volume is achieved. The user receives a message specifying the minimum acceptable end time to make the order valid. Here's a simple illustration that uses clean half hour increments. TWS also calculates for times that fall in between.

Yesterday's Trading Volume:

- 10:00- 10:30 = 200

- 10:30 - 11:00 = 100

- 11:00 - 11:30 = 400

- 11:30 - 12:00 = 100

- 12:00 - 12:30 = 100

- 12:30 - 1:00 = 200

- 1:00 - 1:30 = 300

- 1:30 - 2:00 = 300

Last 30 minutes of trading = 1600

You enter a start and end time of 10:00 - 1:00. Since the trading volume for that time period yesterday was 1100 and the volume for the last 30 minutes was 1600, the order is not accepted. TWS adds the 1:00 - 1:30 volume to get 1400, then the 1:30 - 2:00 volume to get 1700, which is sufficient to make the order valid. You will receive a message saying "The time period for this order is too short. For this start time, use at least 2:00 as the end time."

VWAP orders will be accepted up until 30 minutes before the market close. Any VWAP order accepted after that time and up until one minute before the open will be applied to the market open cut-off.

VWAP order size limits are the lesser of 8% of the average daily volume of the symbol or the amounts in the table below. The limit is applied against the accumulated order size for a symbol during the trading day. Long and short executions will be netted.

| VWAP Time |

Million $ |

| before 9:30 |

10 |

| 9:30-10:00 |

9 |

| 10:00-10:30 |

8 |

| 10:30-11:00 |

7.5 |

| 11:00-11:30 |

7 |

| 11:30-12:00 |

6.5 |

| 12:00-12:30 |

6 |

| 12:30-13:00 |

5.5 |

| 13:00-13:30 |

5 |

| 13:30-14:00 |

4.5 |

| 14:00-14:30 |

4 |

| 14:30-15:00 |

3 |

VWAP sell orders entered at any time and VWAP buy orders entered before the market open cut-off will be accepted for all available minute VWAP stocks. VWAP buy orders entered after the market open cut-off will only be accepted for symbols on the short sell list.

Please note that once your VWAP order is accepted you cannot cancel your order. There are important differences between VWAP transactions and ordinary trades. Please click here for more information and to learn about applicable limitations.