Introduction to Margin

IB Margin Accounts

Interactive Brokers offers several account types, including a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Reg T Margin and Portfolio Margin. New customers must select an account type during the application process, and existing customers can upgrade from Cash or Reg T to Portfolio Margin, via the Trading Access menu in Account Management.

One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio. Depending on the composition of the trading account, margin requirements under Portfolio Margin could be lower than under the Reg T rules. This translates to greater leverage (note that trading with greater leverage involves greater risk of loss). Conversely, for a portfolio with concentrated risk, the requirements under Portfolio Margin may be greater than those under Reg T, as the true economic risk behind the portfolio may not be adequately accounted for under static Reg T calculations. Customers can compare their current Reg T margin requirements for their portfolio with those current projected under Portfolio Margin rules by clicking the Try PM button from their TWS Account Window.

Requirements and supported products for each of these accounts are detailed on the Account Types tab of the Trading Configuration page.

| Regulation (Reg) T Margin |

Borrowing to support equities trading, shorting of equities, options trading, futures/futures options trading, currency conversions and securities/commodities trading in multiple currency denominations available. Purchase and sale proceeds are immediately recognized. |

Margin requirements are computed in real-time under a rules-based calculation methodology, with immediate position liquidation if the minimum maintenance margin requirement is not met. |

| Portfolio Margin |

Borrowing to support equities trading, shorting of equities, options trading, futures/futures options trading, currency conversions and securities/commodities trading in multiple currency denominations available. |

Margin requirements are calculated using a risk-based calculation methodology. Customers must maintain account equity of at least USD 110,000 in order to use a portfolio margin account. Otherwise account restrictions will apply. |

At IB, margin has a different meaning for securities versus commodities. For securities, margin is the amount of cash a client borrows from IB. For commodities, margin is the amount of cash a client must put up as collateral to support a futures contract.

Margin Definition

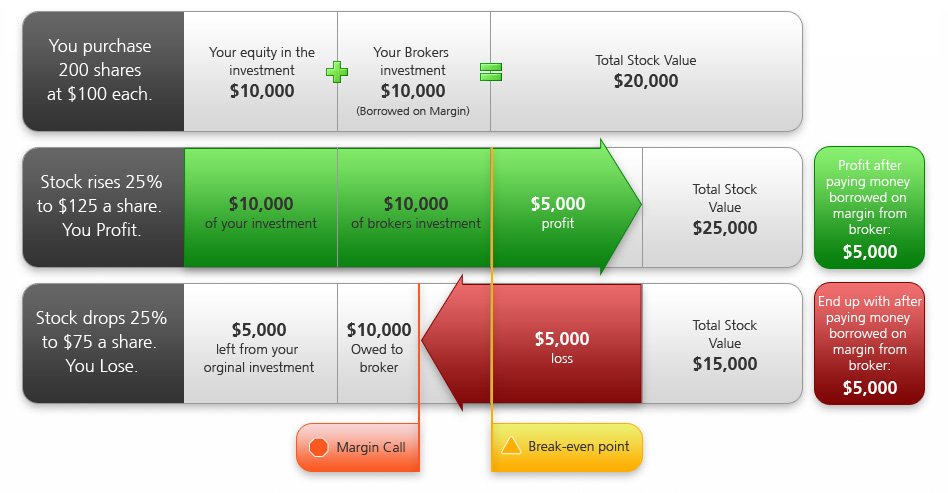

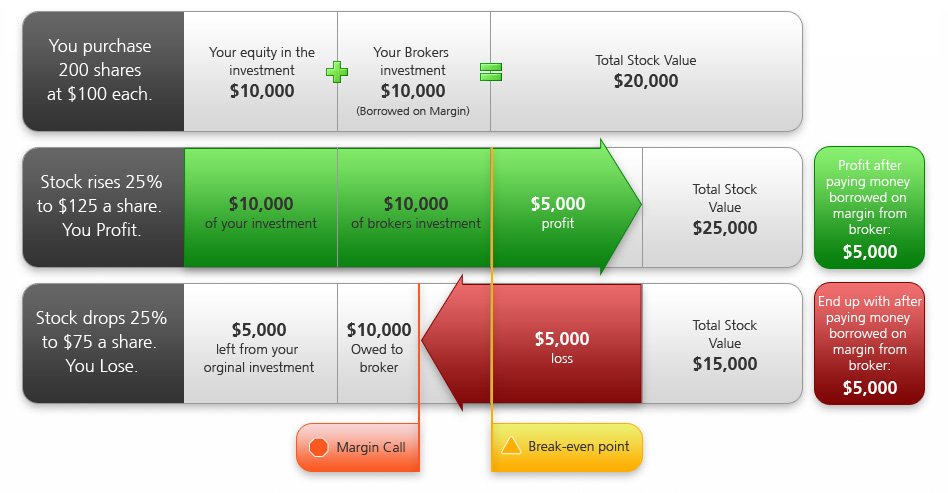

The definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value. The Margin Deposit can be greater than or equal to the Margin Requirement. We can express this as an equation:

Margin Loan + Margin Deposit = Market Value of Security

Margin Deposit >= Margin Requirement

Borrowing money to purchase securities is known as "buying on margin". When an investor borrows money from his broker to buy a stock, he must open a margin account with his broker, sign a related agreement and abide by the broker's margin requirements. The loan in the account is collateralized by investor's securities and cash. If the value of the stock drops too much, the investor must deposit more cash in his account, or sell a portion of the stock.

Initial and Maintenance Margin

The Federal Reserve Board and self-regulatory organizations (SROs), such as the New York Stock Exchange and FINRA, have clear rules regarding margin trading. In the United States, the Fed's Regulation T allows investors to borrow up to 50 percent of the price of the securities to be purchased on margin. The percentage of the purchase price of securities that an investor must pay for is called the initial margin. To buy securities on margin, the investor must first deposit enough cash or eligible securities with a broker to meet the initial margin requirement for that purchase.

Once an investor has started buying a stock on margin, the NYSE and FINRA require that a minimum amount of equity be maintained in the investor's margin account. These rules require investors to have at least 25 percent of the total market value of the securities they own in their margin account. This is called the maintenance margin. For market participants identified as pattern day traders, the maintenance margin requirement is a minimum of $25,000 (or 25% of the total market value of the securities, whichever is higher).

When the balance in the margin account falls below the maintenance requirement, the broker can issue a margin call requiring the investor to deposit more cash, or the broker can liquidate the position.

Brokers also set their own minimum margin requirements called "house requirements". Some brokers extend more lenient lending conditions than others and lending terms may also vary from one client to the other but brokers must always operate within the parameters of margin requirements set by regulators.

Not all securities can be bought on margin. Buying on margin is a double-edged sword that can translate into bigger gains or bigger losses. In volatile markets, investors who borrowed from their brokers may need to provide additional cash if the price of a stock drops too much for those who bought on margin or rallies too much for those who shorted a stock. In such cases, brokers are also allowed to liquidate a position, even without informing the investor. Real-time position monitoring is a crucial tool when buying on margin or shorting a stock.

IB Real-Time Margining

Interactive Brokers uses real-time margining to allow you to see your trading risk at any moment of the day. Our real-time margin system applies margin requirements throughout the day to new trades and trades already on the books and enforces initial margin requirements at the end of the day, with real-time liquidation of positions instead of delayed margin calls. This system allows us to maintain our low commissions because we do not have to spread the cost of credit losses to customers in the form of higher costs.

Our real-time margin system allows you to see your trading risk at any moment of the day using the real-time activity monitoring features in Trader Workstation. For more information about real-time margin monitoring, see the Real-Time Monitoring Margin page.

Universal AccountSM

Your Interactive Brokers Universal Account is authorized to trade both securities products and commodities/futures products and therefore consists of two underlying accounts, a securities account governed by rules of the U.S. Securities and Exchange Commission (SEC) and a futures account governed by rules of the U.S. Commodity Futures Trading Commission (CFTC).

Whether you have assets in an IB securities account or in an IB futures account, your assets are protected by U.S. federal regulations governing how brokers like IB must protect your property and funds. In the IB securities account, your assets are protected by SEC and SIPC rules. In the IB futures account, your assets are protected by CFTC rules requiring segregation of customer funds. You are also protected by IB's strong financial position and our conservative risk management philosophy. See IB's Strength & Security page.

As part of the IB Universal Account service, IB is authorized to automatically transfer funds as necessary between your IB securities account and your IB futures account in order to satisfy margin requirements in either account. You can configure how you want IB to handle the transfer of excess funds between accounts on the Excess Funds Sweep page in Account Management: you can choose to sweep funds to the securities account, to the futures account, or you can choose to not sweep excess funds at all.

Margin Model

Margin requirements are calculated either on a rules basis and/or a risk basis.

| Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions ("strategies"). |

Reg T accounts: US stocks, index options, stock options, single stock futures, and mutual funds.

All accounts: Forex; bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. |

| Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together (for example, a future and all the options delivering that future). |

Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds.

All accounts: All futures and future options in any account. Non-US/Non-Canadian stock options and index options in any account. |

Margin requirements for each underlying are listed on the appropriate exchange site for the contract. A summary of the requirements for the major futures contracts as well as links to the exchange sites are available on our Futures Margin Requirements page.

Extreme Margin Model

Systems that derive risk-based margin requirements deliver adequate assessments of the risk for complex derivative portfolios under small/moderate move scenarios. Such systems are less comprehensive when considering large moves in the price of the underlying stock or future. IB has enhanced the basic exchange margin models with algorithms that consider the portfolio impact of larger moves up 30% (or even higher for extremely volatile stocks). This 'Extreme Margin Model' may increase the margin requirement for portfolios with net short options positions, and is particularly sensitive to short positions in far out-of-the-money options.

If you sell a security short, you must have sufficient equity in your IB account to cover any fees associated with borrowing the security. If you borrow the security through IB, IB will borrow the security on your behalf and your account must have sufficient collateral to cover the margin requirements of the short sale.To cover administrative fees and stock borrowing fees, IB must post 102% of the value of the security borrowed as collateral with the lender. In instances in which the security shorted is hard to borrow, borrowing fees charged by the lender may be so high (greater than the interest earned) that the short seller must pay additional interest for the privilege of borrowing a security. Customers may view the indicative short stock interest rates for a specific stock through the Short Stock (SLB) Availability tool located in the Tools section of their Account Management page. For more information concerning shorting stocks and associated fees, visit the "Shortable Stock" page on the IB website

Note:

- In the interest of ensuring the continued safety of its clients, IB may modify certain margin policies to adjust for unprecedented volatility in financial markets. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized.

- IB is focused on prudent, realistic, and forward looking approaches to risk management. In order to provide the broadest notification to our clients, we will post announcements to the IB System Status page. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes.

- Note that the credit check for order entry always considers the initial margin of existing positions. Therefore, although an account may be holding an existing position at 35%, for example, it is the initial margin requirement of that position that is used in the credit check calculation for order acceptance.