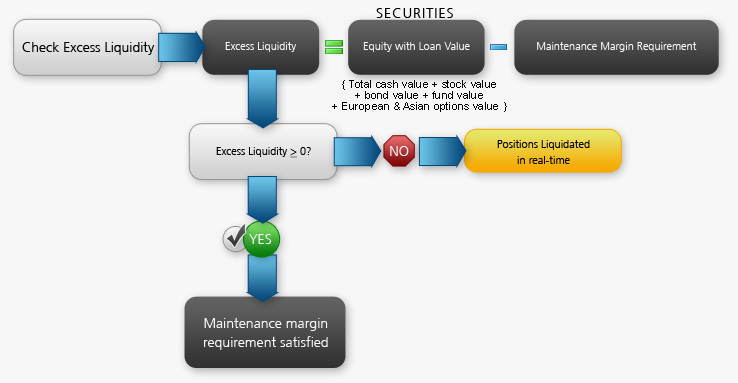

Real-Time Maintenance Margin Calculation

Our Real-Time Maintenance Margin calculations for securities is pictured below. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity.

Example: Securities Real-Time Maintenance Margin Calculation

Excess Liquidity >= 0

(Excess Liquidity= Securities Equity with Loan Value - Maintenance Margin Requirement)

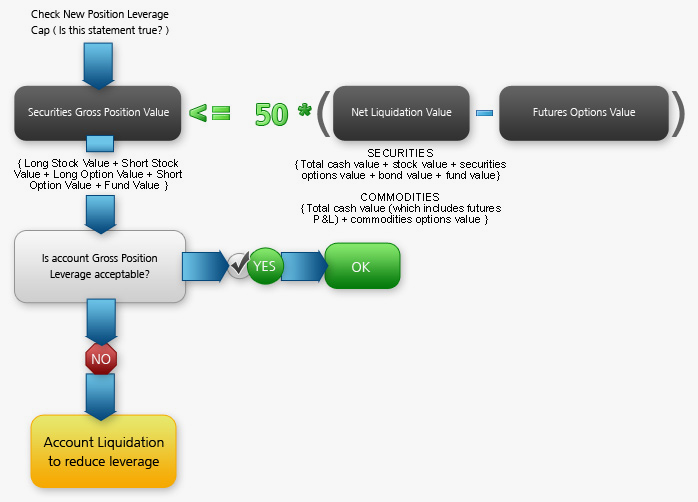

Real-Time Gross Position Leverage Check

There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. The calculation is shown below.

Example: Real-Time Gross Position Leverage Check

Securities Gross Position Value <= 50 * (Net Liquidation Value - Futures Options Value)

If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage.

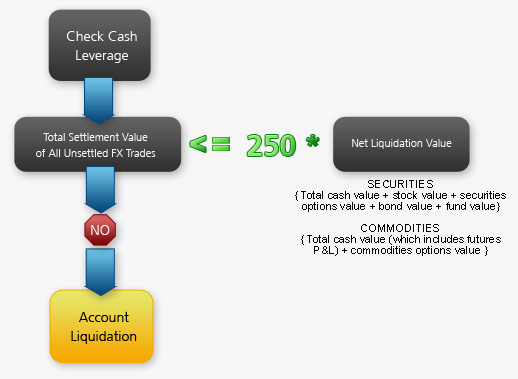

Real-Time Cash Leverage Check

An additional leverage check on cash is made to ensure that the total FX settlement value is no more than 250 times the Net Liquidation Value as shown below.

Real-Time Cash Leverage Check

Total Settlement Value of All Unsettled FX Trades <= 250 * (Net Liquidation Value)

If the result of this calculation is not true, account liquidation may occur.

Decreased Marginability Calculations

We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding (SHO) of a company. For Reg T securities accounts, this algorithm increases the margin requirement for stock positions exceeding 1% of the published SHO from its default to 100% (in other words, decreases the amount of money that can be borrowed against a stock position toward zero). At 5% concentration, positions have a 100% margin requirement.

Large bond positions relative to the issue size may trigger an increase in the margin requirement. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Less liquid bonds are given less favorable margin treatment.

Soft Edge Margining

We will automatically liquidate when an account falls below the minimum margin requirement. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin (SEM) during the trading day. From the start of the trading day until 15 minutes before the close of the trading day, Soft Edge Margin allows for an account's margin deficit to be within a specified percentage of the account's Net Liquidation Value, currently 10%. When SEM ends, the full maintenance requirement must be met. When SEM is not applicable, the account must meet 100% of maintenance margin.

Soft Edge Margin start time of a contract is the latest of:

- the market open, the latest open time if listed on multiple exchanges;

- or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Soft Edge Margin end time of a contract is the earliest of:

- 15 minutes before market close, the earliest close time if listed on multiple exchanges;

- or 15 minutes before the end of liquidation hours;

- or the start of Reg T enforcement time.

If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. This allows a customer's account to be in margin violation for a short period of time. Soft Edge Margin is not displayed in Trader Workstation. Once the account falls below SEM however, it is then required to meet full maintenance margin.

Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility.