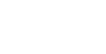

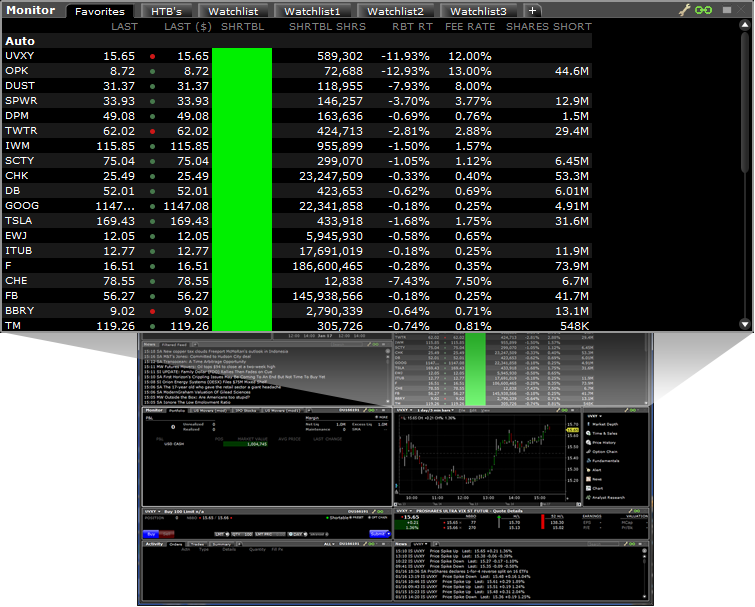

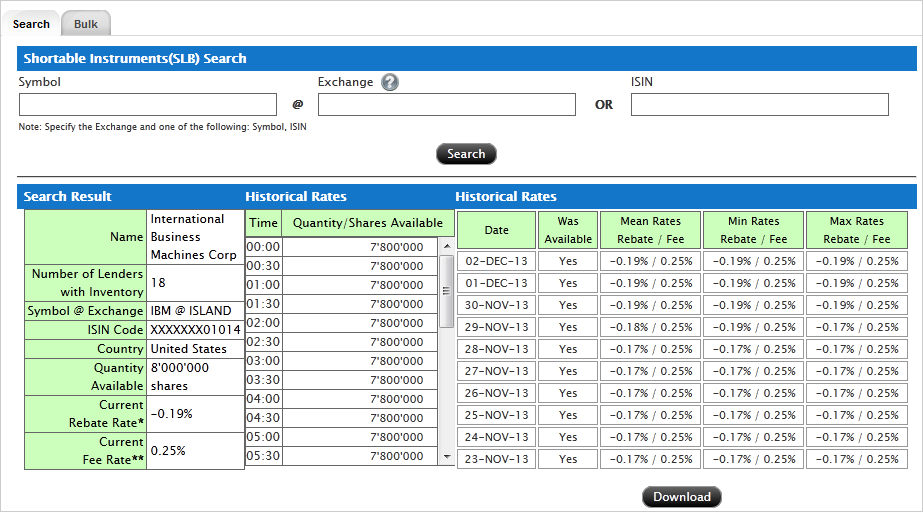

IBSM, InteractiveBrokers.com ®, IB Universal AccountSM, Interactive Analytics ®, IB Options AnalyticsSM, IB SmartRoutingSM, Portfolio AnalystTM and IB Trader WorkstationSM are service marks and/or trademarks of Interactive Brokers LLC. Supporting documentation for any claims and statistical information will be provided upon request. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

The risk of loss in online trading of stocks, options, futures, forex, foreign equities, and bonds can be substantial. Options are not suitable for all investors.

For more information read the "Characteristics and Risks of Standardized Options". For a copy visit http://www.theocc.com/about/publications/character-risks.jsp. Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclaimers page - http://www.interactivebrokers.com/disclosure. Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see http://www.interactivebrokers.com/interest. Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, please read the Security Futures Risk Disclosure Statement. For a copy visit http://www.interactivebrokers.com/disclosure. There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

INTERACTIVE BROKERS ENTITIES