| 1977 |

- Thomas Peterffy, the Chairman of the Interactive Brokers Group, buys a seat on the American Stock Exchange (AMEX) and becomes a member, trading as an individual market maker in equity options.

|

| 1978 |

- T.P. & Co. is formed to expand trading activities to several members under badge number 549. The firm is the first to use computer generated fair value sheets printed daily.

|

| 1979 |

- T.P. & Co. expands to four employees, three of whom are AMEX members.

|

| 1980 |

- Plans are made to restructure the operation and to identify price anomalies in several securities at the same time.

|

| 1981 |

- Efforts are made to code and test a system that identifies potential delta neutral trade pairs. Our greatest challenge: how to electronically read the prices of options as they are posted.

|

| 1982 |

- Timber Hill Inc. is formed. Initially, the company trades equity options at the AMEX, clearing through Spear, Leeds & Kellogg. Traders receive telephone instructions identifying pairs and prices.

|

| 1983 |

- Timber Hill creates the first handheld computers used for trading. Their ability to track positions and continually re-price options on one stock quickly gives Timber Hill traders an advantage over their counterparts at the exchange, who continue to use fair value pricing sheets that are updated only once or twice a day.

- Timber Hill begins trading at the Philadelphia Stock Exchange.

- Timber Hill expands to 12 employees.

|

| 1984 |

- Timber Hill begins coding a computerized stock index futures and options trading system.

- Timber Hill becomes a member of The Options Clearing Corporation.

|

| 1985 |

- In February, Timber Hill's new computer system and network is brought online, ushering in a new era of computerized trading. The system allows Timber Hill to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country.

- Timber Hill becomes a member of the New York Futures Exchange.

- Timber Hill begins trading at the Chicago Mercantile Exchange(CME), the Chicago Board of Trade and the Chicago Board Options Exchange.

|

| 1986 |

- Timber Hill becomes a member of the Pacific Stock Exchange and the Options Division of the New York Stock Exchange (NYSE).

- The trading system is reprogrammed to operate on a network of SUN workstations.

- The firm's traders generate a 430% return on equity for the year with the new system.

|

| 1987 |

- Timber Hill becomes self-clearing in equities, joining the National Securities Clearing Corp. and the Depository Trust Company.

- The stock market crash creates the impetus for cross margining between clearing houses with Timber Hill as a major proponent. (Cross-margining emerges several years later).

- Timber Hill expands to 67 employees.

|

| 1989 |

- Timber Hill becomes a clearing member at the CME.

|

| 1990 |

- Timber Hill Deutschland GmbH is incorporated in Germany, and shortly thereafter, begins trading equity derivatives at the Deutsche Terminborse (DTB), now Eurex. This is Timber Hill's first application of its trading system on a fully automated exchange.

- Timber Hill becomes one of the leading market makers at the DTB, claiming more than 10% of the trading volume.

|

| 1992 |

- Timber Hill expands its European trading to the Swiss Options and Financial Futures Exchange (SOFFEX), another fully automated exchange.

- Timber Hill expands to 142 employees.

|

| 1993 |

- Timber Hill Europe AG is incorporated in Switzerland and takes over the Group's trading at SOFFEX.

- In the United States, Timber Hill floor traders begin using commercially available handheld computers on the exchange floors, communicating by radio with the firm's central pricing systems. The hand-helds allow traders to create electronic trade tickets.

- Interactive Brokers Inc. (now known as IB LLC) is incorporated as a US broker-dealer, making Timber Hill's vast intercontinental electronic network and trade execution services available to customers.

|

| 1994 |

- Timber Hill Europe begins trading at the European Options Exchange in the Netherlands, the OM Exchange in Sweden (an electronic exchange) and the London International Financial Futures and Options Exchange (LIFFE) in the U.K.

- Timber Hill Deutschland becomes a member of the electronic Belgian Futures and Options Exchange.

- IB LLC becomes a member of the NYSE and begins executing stock trades through SuperDot, the electronic order routing system.

- IB LLC is regularly named one of the top ten program traders at the NYSE.

- Timber Hill UK Limited is incorporated. Shortly thereafter, Timber Hill UK takes over Timber Hill's trading at LIFFE.

- Timber Hill Hong Kong Limited is incorporated.

- The Timber Hill Group LLC is formed as the holding company for all of Timber Hill's operating companies.

|

| 1995 |

- Timber Hill France S.A. is incorporated and begins making markets at the Paris Traded Equity Options Market and the Marché à Terme International de France futures exchange.

- Timber Hill Hong Kong begins making markets at the Hong Kong Futures Exchange.

- Timber Hill Europe expands its activities into the Italian Mercato Italiano Futures and Spanish Meff Renta Variable markets.

- IB LLC creates a customer workstation, through which professional customers gain access to exchanges around the world.

- IB LLC executes its first trades for public customers.

|

| 1996 |

- Timber Hill doubles the number of underlying stocks that it trades to more than 800.

- Timber Hill Securities Hong Kong Limited is incorporated and begins trading at the Stock Exchange of Hong Kong.

|

| 1997 |

- The Hong Kong Futures Exchange lists stock index futures on an electronic market. Timber Hill Hong Kong is the only committed market maker.

- Timber Hill Australia Pty Limited is incorporated in Australia.

- Timber Hill Europe begins trading in Norway and becomes a member of the Austrian Derivatives Exchange.

- With strong support from Timber Hill, the S&P 500 E-Mini futures becomes the first US electronic market and the most successful futures contract ever introduced.

- The Timber Hill Group now makes bids and offers for 60,000 items.

- Timber Hill trades just less than 5% (15,000 transactions) of the daily volume in listed equity derivatives worldwide. Timber Hill expands to 284 employees.

|

| 1998 |

- IB begins to clear online trades for retail customers who are connected directly to Globex to trade S&P futures.

- Timber Hill Canada Company is formed.

|

| 1999 |

- IB provides a "smart routing" linkage for multiple listed equity options.

- IB begins to clear online trades for customers trading stocks and equity derivatives through the IB system.

|

| 2000 |

- On average, more than six percent of the daily global volume of exchange-traded equity options and equity futures is now traded across the Timber Hill/IB network.

- In the course of the year, IB LLC's customer base increased nearly 500%.

- Timber Hill becomes a Primary Market Maker on the ISE (International Securities Exchange), the first fully electronic US options exchange.

- Interactive Brokers (U.K.) Limited is formed.

|

| 2001 |

- The corporate name of The Timber Hill Group LLC is changed to the Interactive Brokers Group LLC.

- The group's combined electronic brokerage and market making firms' volume now exceeds 200,000 trades per day.

- Standard & Poor's issues an investment grade rating to Timber Hill LLC. For more information on Standard & Poor's visit: http://www.standardandpoors.com.

|

| 2002 |

- Interactive Brokers, the Bourse de Montreal and the Boston Stock Exchange announce the formation of a partnership to create the Boston Options Exchange (BOX).

- Timber Hill begins electronic market making in Japan.

- Interactive Brokers provides customers with an IB Universal AccountSM that allows trading of stocks, options, futures, and exchange traded funds around the world from a single account.

- Interactive Brokers gives Financial Advisors the ability to open separately managed Accounts to manage money for multiple clients.

- Application Program Interface (API) introduced which gives customers and third-party developers the ability to directly integrate with the IB trading system.

- MobileTrader launched which gives IB customers the ability to trade anywhere.

- Timber Hill becomes the major market maker for the newly introduced US Single Stock Futures.

|

| 2003 |

- The Interactive Brokers Group companies transacted approximately 12% of the exchange listed equity and index options worldwide.

- Interactive Brokers expands execution and clearing services to include Canadian stocks, equity/index options and futures, Italian index options and futures, German equity options, Japanese index options and futures, Dutch index options and futures, UK equity options and Belgian index options and futures.

|

| 2004 |

- Interactive Brokers introduces Direct Access Bond Trading, Institutional FOREX, Singapore Futures, German Warrants, French and Dutch stocks and options, CBOE Futures and trading on the Frankfurt/Stuttgart exchanges. Our Intermarket Spread Router searches across all exchanges for the best price on each individual leg of a spread order. We upgraded our account management platform to include a new release of our Trader Workstation, real time charts, scanners, fundamental analytics, BookTrader, OptionTrader, and Advisor account allocations.

- Standard and Poor's issues an investment grade rating for Interactive Brokers Group LLC. For more information on Standard & Poor's visit: http://www.standardandpoors.com.

|

| 2005 |

- IB is ranked the #1 software based broker, and #1 for lowest trade cost by Barron's.

- IBG is ranked the 16th largest US securities firm by Institutional Investor.

- The Interactive Brokers Group companies executed over 16% of the world's options on markets where they actively traded.

- IDEALPRO is launched providing traders with tight forex quotes from multiple bank dealers in a single quote montage.

|

| 2006 |

- The IB Options Intelligent Report is launched to focus investors' attention on unusual concentration of trading interests and changing levels of uncertainty in the option markets.

- The Interactive Brokers Group takes stakes in OneChicago, the ISE Stock Exchange, and the CBOE Stock Exchange in its efforts to further innovation in the trading industry.

- Interactive Brokers leaps ahead of the industry by being the first to offer penny-priced options.

|

| 2007 |

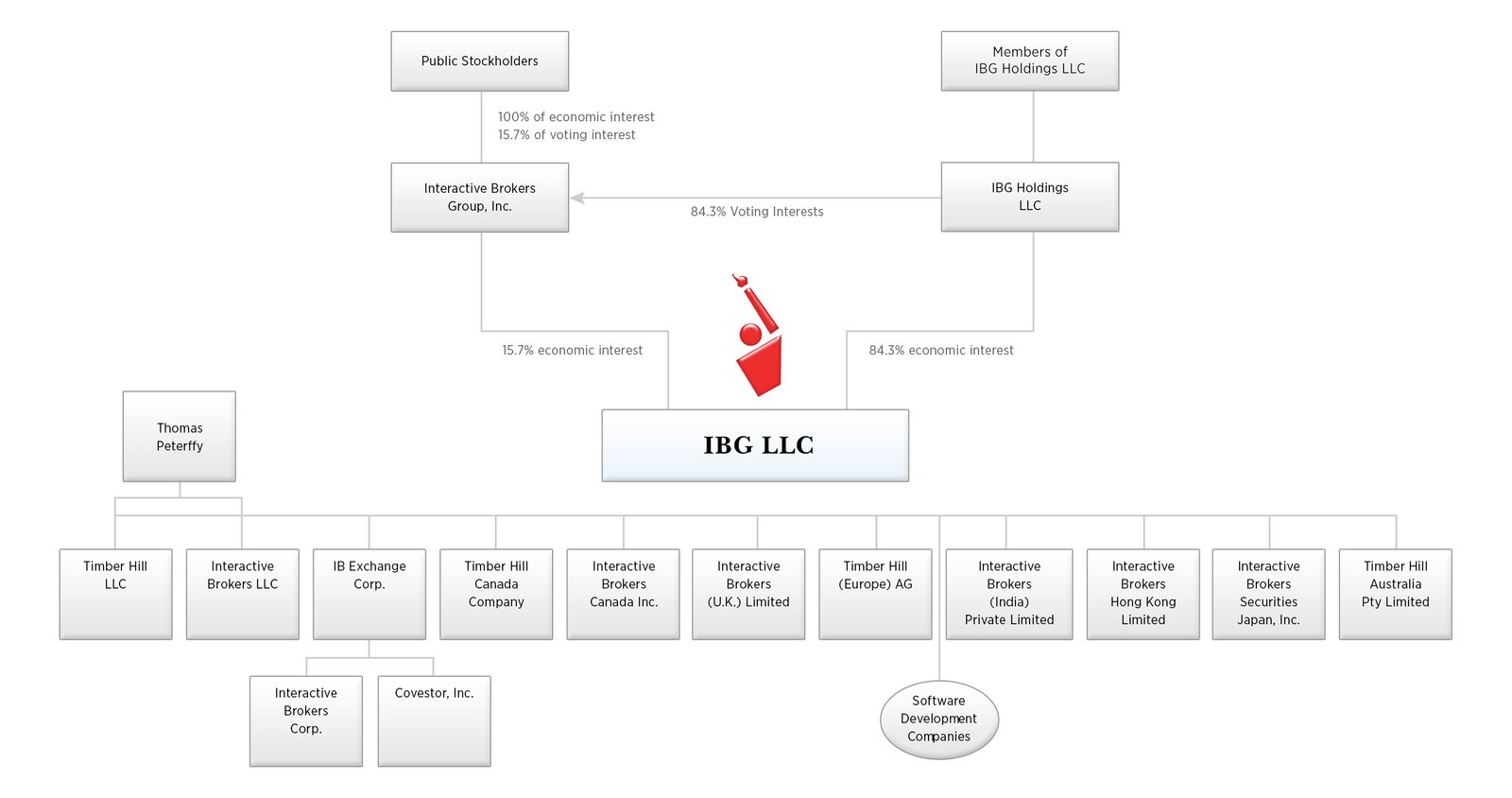

- On May 3rd Interactive Brokers Group, Inc. sold 40,000,000 shares in a public offering at $30.01 per share. The float represents approximately 10% interest in Interactive Brokers Group LLC. The members of LLC have the right to sell an additional 12.5% interest to the public in each of the coming seven years. Please refer to the chart at the bottom of the page for our new ownership structure.

- A real-time Portfolio Margin platform is introduced allowing customers trading multiple asset classes to increase their leverage with greater safety.

- Exchange for Physicals are launched providing customers with a market determined AAA rated financing alternative to randomly set broker rates.

- The Transaction Auditing Group, a third-party provider of audit services, determines that Interactive Brokers' customer equity options orders were improved 14.85% of the time vs. an industry improvement rate of 0.57%.

|

| 2008 |

- The IB Risk NavigatorSM is launched, a real-time market risk management platform for customers, providing unified risk data across multiple asset classes around the globe.

- Interactive Brokers adds Mexican Stocks/Options/Futures, Spanish Stocks, US Treasury Bonds/Bills/Notes, Australian CFD's, and US No Load Mutual Funds to its Suite of Trading Products.

- A complete family of trading algorithms was introduced to the Trader Workstation including an industry first, the Accumulate-Distribute Algo which allows traders to take advantage of a temporary lack of liquidity.

|

| 2009 |

- According to Barron's Magazine, Interactive Brokers maintains its position as "the least expensive trading venue for investors," and holds the ranking as the #1 Lowest Cost Broker for the fifth straight year.

- The free iTWS trading app for the iPhoneTM is launched for customers and provides free utilities for non-customers as well, including real-time forex quotes, email price alerts, and exchange-delayed market data, charts and scanners.

- Interactive Brokers releases the Portfolio Analyst, an online tool that allows investors to evaluate the performance of their portfolio and measure their performance against over 80 popular benchmarks.

- Interactive Brokers offers electronic market access via TWS to AQS®, the first automated, centrally-cleared electronic marketplace for Stock Borrow and Loan transactions.

- Interactive Brokers supports trading on over 80 different venues, including the National Stock Exchange of India (NSE) for both India residents and Non-Resident Indians (NRIs).

|

| 2010 |

- Enhanced support for bond trading is added to the Trader Workstation, including a more powerful US Corporate Bonds scanner and support for trading municipal bonds.

- IB LLC is awarded a stand-alone rating of "A-/A-2; Outlook Stable" by Standard and Poor's, based on its solid financial profile.

- 2010 TAG statistics show that IB continues to top the industry in US stock and options price improvement.

- Interactive Brokers pays a special cash dividend of $1.79 per share amounting to approximately $1 billion pretax, and still has consolidated equity capital in excess of $4 billion.

|

| 2011 |

- IBIS, Capital Introduction for hedge funds, Stock Yield Enhancement and mobileTWS for iPad are released.

- Interactive Brokers becomes the largest online US broker as measured by Daily Average Revenue Trades reported.

|

| 2012 |

- Interactive Brokers pays a special cash dividend of $1.00 per share amounting to approximately $409 million pretax, and still has consolidated equity capital in excess of $4 billion.

- IB begins offering Wealth Manager and Money Manager advisor accounts and opens the fully-electronic Money Manager Marketplace.

- The TWS Mosaic trading interface and the Tax Optimizer for managing capital gains/losses are released.

- IB takes first place in Barron's annual Best Online Brokers review, receiving four-and-a-half out of five stars as the Best Online Broker overall.

|

| 2013 |

- IB's Hedge Fund Capital Introduction ramps up with 60% of funds receiving at least one investment and the funds reporting an average 2013 rate of return of 20%.*

- IB releases the Probability Lab options trading tool in TWS, providing a revolutionary and practical way to think about options without the complicated mathematics.

- IB integrates IB FYI automated portfolio-relevant notifications into the TWS, providing guidance such as shares becoming available for borrowing and options that make sense to exercise.

- IB launches the Traders' Insight, a blog tool, providing market insight directly from global market participants to the trading and investing public.

- For the second year in a row, IB is ranked number one by Barron's annual Best Online Brokers review and is named Best Online Broker overall.

|

| 2014 |

- IB begins publishing our "Simple Monthly Cost of Execution" comparing our all-in execution cost to the daily VWAP value for all customer executions, and encourages the SEC to consider requiring all broker-dealers conducting customer business to supplement their existing Rule 606 routing reports with these simple monthly statistics.

- IB introduces the Transaction Cost Analysis (TCA) reporting tool to help customers evaluate execution performance and optimize execution strategies.

- For the third year in a row, IB is ranked number one and named Best Online Broker overall by Barron's annual Best Online Brokers review.

- IB becomes an exchange participant in the groundbreaking Shanghai-Hong Kong Stock Connect program, allowing our Hong Kong and international clients to trade designated securities on the Shanghai Stock Exchange.

|

| 2015 |

- IB launches the Investors' Marketplace, an online service where traders and investors, advisors, fund managers, research analysts, technology providers, business developers and administrators can meet and do

business together.

- IB introduces additional resources for advisors, including CRM (Customer Relationship Management), a fully-integrated system where advisors manage their entire customer relationship life cycle in one place; and the RIA Compliance Center, an important resource for advisors starting and registering their own advisory firms.

- For the fourth year in a row, IB is ranked number one and named Best Online Broker overall by Barron's annual Best Online Brokers review.

- IB acquires Boston-based Covestor, an online investing marketplace and digital asset management company.

- IB releases the Portfolio Builder trading tool in TWS, allowing traders to create an investment strategy driven by top-tier research and

fundamentals data, then back-test and adjust as needed.

|