Ranking Logic

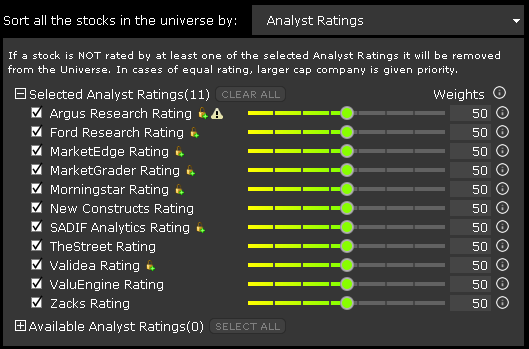

For each analyst the user selects, an analyst score is given to each stock in the set that remains after all applied filters have been satisfied, including index membership, industry, closing price range etc. The score is a basic sort, according to the analyst's rating category (i.e. 1 star 5 star) and market cap (largest market caps sorted higher for buy-rated stocks, lower for sell-rated stocks) which is nested within the category rating. These are then spread across an arbitrary interval of 0 20000 and ranked according to each stock's average analyst scores. The ranking is repeated at the close of each rebalance period (which is defined by the user).

Let's look at an example using Morningstar and TheStreet as ranking providers. Let's assume that five stocks remain after filtering. To calculate the final ranking, first we take the ratings of those stocks and assign a value on an arbitrary interval of 0 to 20,000:

| |

Morningstar Rating |

TheStreet Rating |

| Stock1 |

5 Star (20000) |

A+ (20000) |

| Stock2 |

2 Star ( 5000) |

C- ( 0) |

| Stock3 |

1 Star ( 0) |

B (10000) |

| Stock4 |

3 Star (10000) |

B+ (15000) |

| Stock5 |

4 Star (15000) |

C ( 5000) |

Let's use the sliders to weight Morningstar at 100% and TheStreet at 40%. In this case, the weighted averages of these stocks would be:

| |

Ranking Calculation |

Outcome |

| Stock1 |

(100*20000 + 40*20000) / (100 + 40) = 20000 |

1 |

| Stock2 |

(100* 5000 + 40* 0) / (100 + 40) = 3571 |

4 |

| Stock3 |

(100* 0 + 40*10000) / (100 + 40) = 2857 |

5 |

| Stock4 |

(100*10000 + 40*15000) / (100 + 40) = 11428 |

3 |

| Stock5 |

(100*15000 + 40* 5000) / (100 + 40) = 12142 |

2 |

Notice that by using the slide to weight Morningstar at 100% and TheStreet at 40%, stock 2 comes out with a higher rank than stock 3 even though

TheSteet had ranked stock 3 two steps above stock 2.

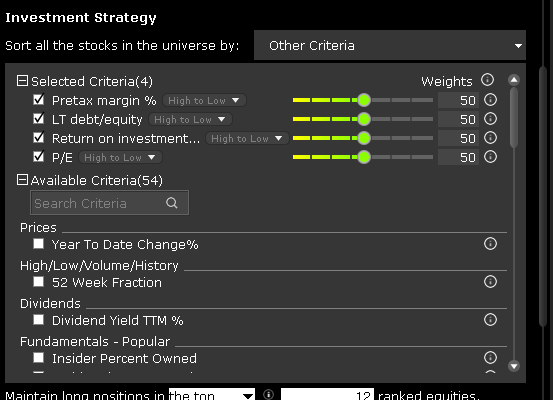

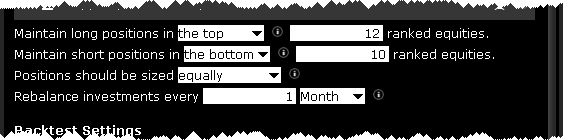

In the above example, if you buy the highest ranked two stocks and sell the lowest two ranked stocks, you'll be buying stocks 1 and 5 and selling stocks 2 and 3. But how do we know much of each we will buy and sell?

If we select equal sizing, we will purchase the same dollar amount of stock 5 as of stock 1 and sell the same dollar amounts each of stocks 2 and 3. (say buy $100k of stock 1, buy $100k of stock5, sell $100k of stock 2, sell $100k of stock3).

If we select proportional sizing, we'll buy more of stock 1 than stock 5 since it was ranked higher, and sell more of stock 3 than stock 2 since it was ranked lower. The exact amount we would buy or sell is proportional to the score and is calculated as: