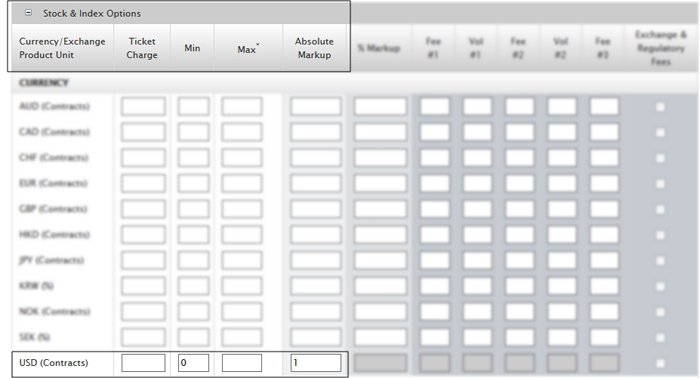

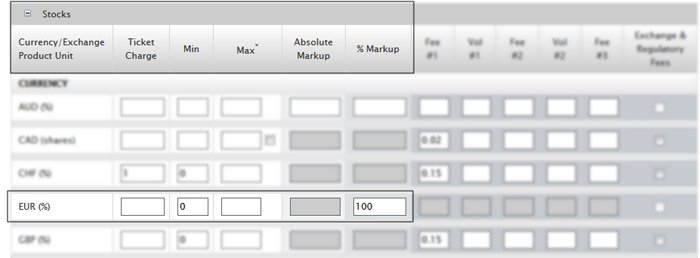

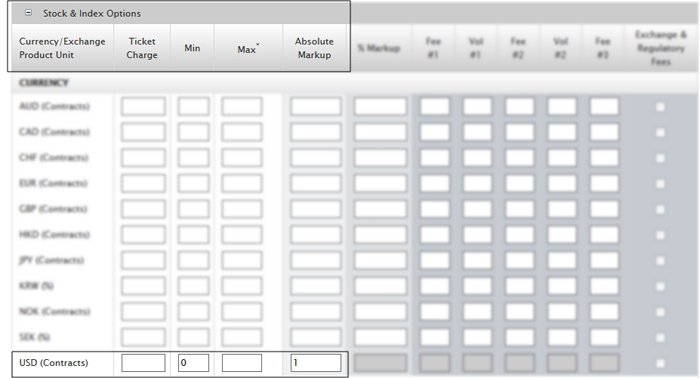

Absolute Markup

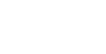

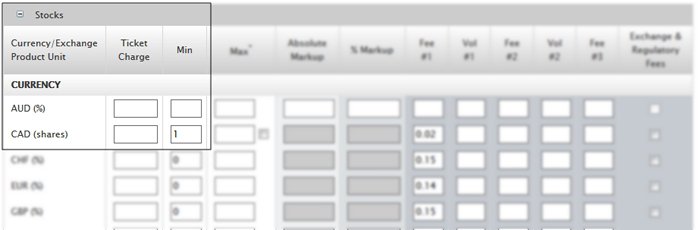

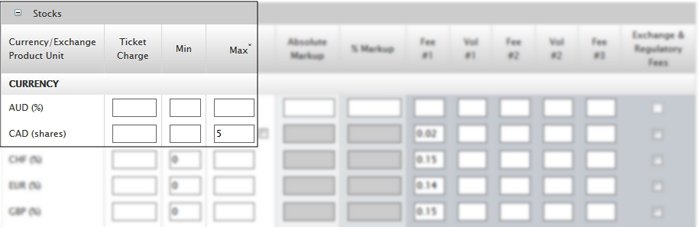

Brokers can charge an Absolute Markup per trade. Absolute Markup is a specific amount added to the Interactive Brokers commission. Brokers enter an Absolute Markup in the currency or exchange of the asset class. On the Client Fees page in Account Management, the units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or % of notional value. Absolute Markup amounts can include up to three decimal places.

Example

For example, a broker enters 1 as the Absolute Markup for USD Stock and Index Options. Later, one IB Smart option contract is executed. The client will be charged $2 ($1 IB commission + $1 Absolute Markup).

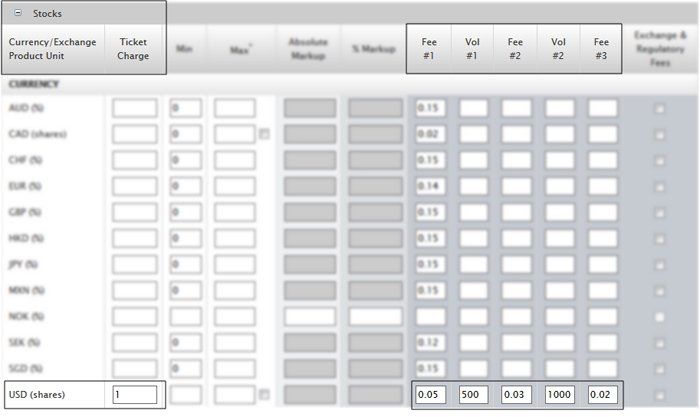

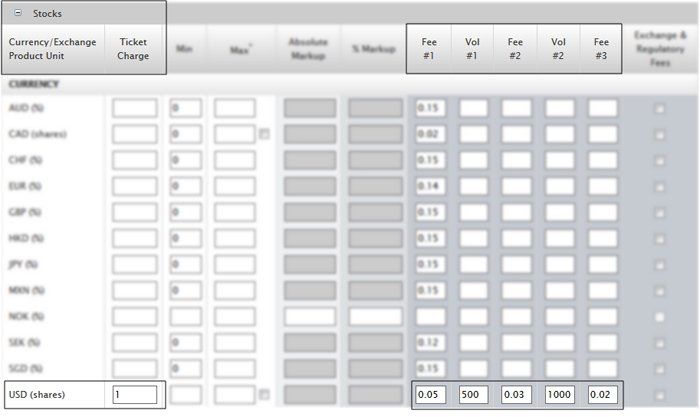

Tiered Absolute Amount

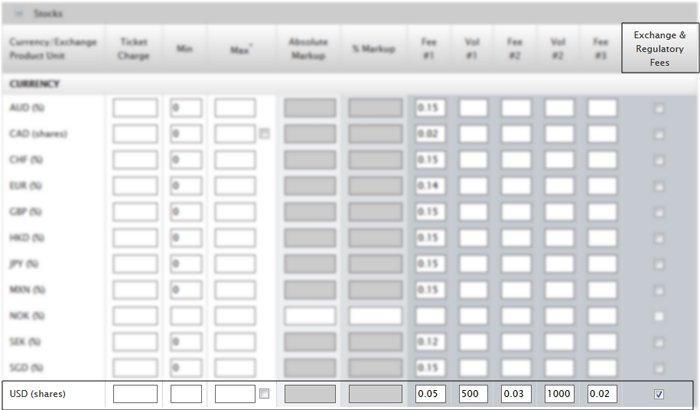

Brokers can charge an Absolute Amount from which Interactive Brokers' commission is subtracted. You can set up to three tiers for Absolute Amount based on volume breaks. Brokers should monitor their clients commissions as it is possible for Interactive Brokers to charge more than the client fee.

To set an Absolute Amount, enter one to three fees (Fee#1, Fee#2, Fee#3), and enter volume breaks (Vol#1, Vol#2) on a per trade basis on the Client Fees page in Account Management. The units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or %. Absolute Amounts can include up to three decimal places.

Example

For example, a broker wants to charge 0.05 USD for up to 500 shares of stock, 0.03 USD for up to 1,000 shares, and 0.002 USD above 1,000 shares, along with a ticket charge of 1 USD.

Client Absolute Tiered Commissions are mutually exclusive from Interactive Brokers Tiered Commissions. They can be combined with IB Tiered Commissions, or one client absolute rate can be used with IB Tiered Commissions.