- English

-

-

Search

- Log In

-

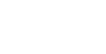

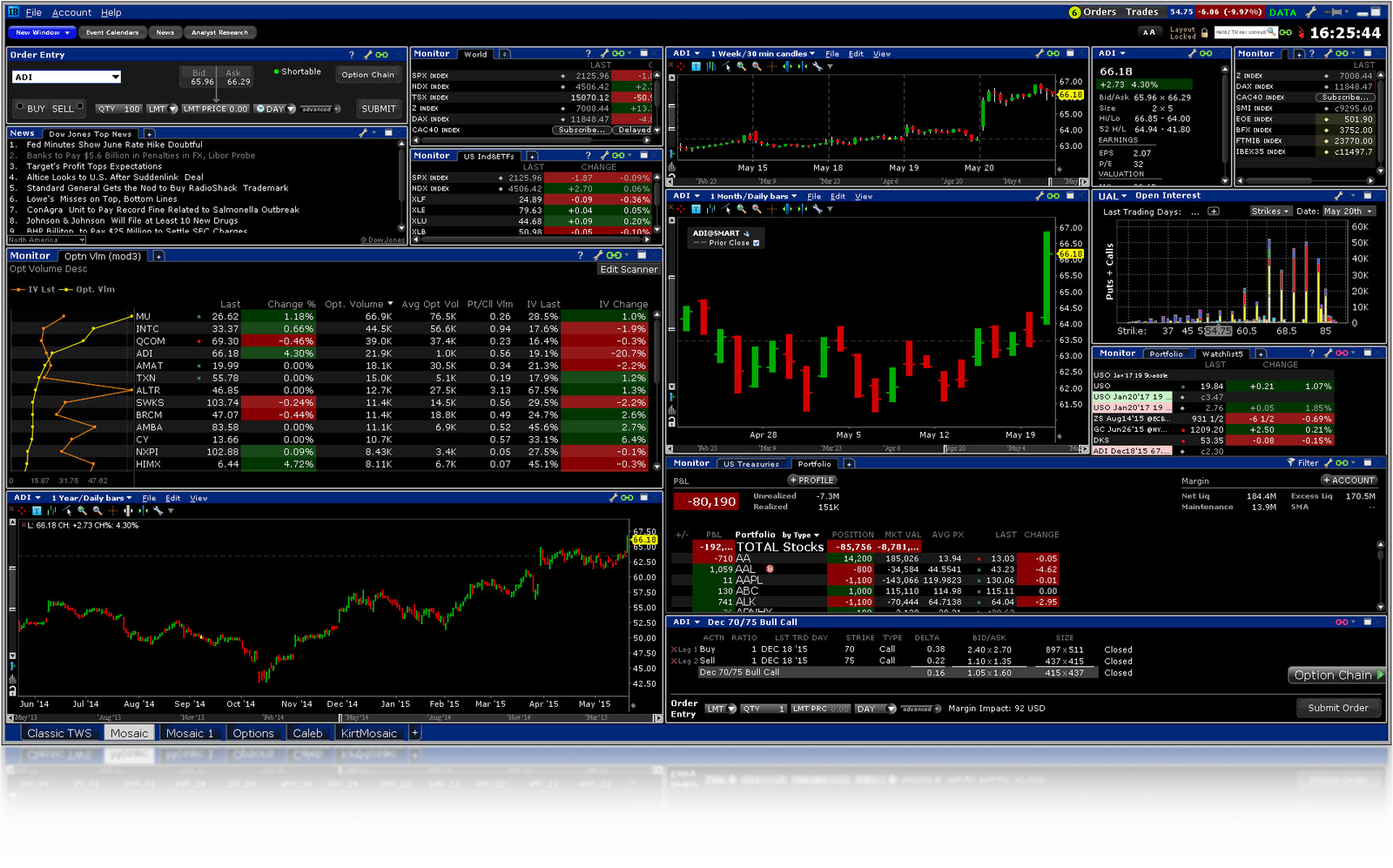

Trader Workstation

- TWS Latest

- TWS

- TWS Beta

Account Management

- Account Management

- Finish an Application

WebTrader

- WebTrader

- WebTrader Beta

API Access

- IB Gateway Latest

- IB Gateway

-

- Open Account

- Free Trial

- TRADING

-

PLATFORMS

- Platform Demos

TECHNOLOGY

- Third Party Integration

PRODUCTS

- Account Management

- Investors' Marketplace

-

- EDUCATION

- ABOUT IB

-

OTHER RESOURCES

- Information and History

- Awards

- News

- Media

- Live Events

- Investor Relations

-

- CONTACT US

- Search

- Account Management Log In

- Open Account

- Free Trial

- Language