Manage Registration Tasks for Client Accounts

We give Advisors and Fully Disclosed Brokers several ways to manage and track the progress of client account applications in the Dashboard in Account Management:

- Download a list of outstanding registration tasks for all pending client accounts to Microsoft Excel.

- View all registration tasks.

- Generate a PDF version of the account application.

- Delete a pending client account application.

Fully Disclosed Brokers can also:

- Approve or reject pending client applications and pending client options trading permissions.

- View application and options trading approvals for all accounts.

- See which user deleted client account applications.

Advisors can also:

Use the Dashboard in Account Management to quickly and easily access information about your clients and their account applications, and drill down to view and manage information for individual client accounts.

Both Advisors and Brokers can use the Dashboard to:

- View a list of all client accounts.

- View recent activity for the past five days for all client accounts.

- Search for and sort client accounts by account title, account type, account number, username or account alias.

- Filter all client accounts by account status.

- Download a list of outstanding registration tasks for all pending client accounts to Microsoft Excel.

- Download information about all client accounts to Microsoft Excel.

- Drill down to view complete details of and perform editing and reporting tasks for each client account.

In addition, Advisors and Brokers can each perform additional tasks in the Dashboard.

Note: For more detailed information about the Dashboard, see Dashboard in the Account Management Users' Guide.

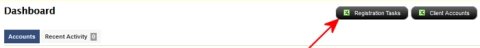

Here is a typical Advisor Dashboard:

Here is a typical Broker Dashboard:

To download a list of outstanding registration tasks for all pending client accounts to Microsoft Excel

You can download an Excel spreadsheet (.xls file) that includes all registration tasks for your pending client or fund accounts (i.e., all tasks related to the opening of all of your pending client or fund accounts). The Excel file shows the Account ID, tasks and current status of each tasks for all pending client or fund accounts.

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Click the Registration Tasks button located at the top right of the screen.

- You will be prompted to open or save a Microsoft Excel worksheet. Save the file to your computer.

To view all registration tasks for a specific client account

- Log in to Account Management, and then click Manage Clients > Dashboard..

- Search or sort the account list to find the account of interest, and then click the account row to display the Client Account Details page for that client.

- At the bottom of the Client Account Details page, click the Registration Tasks button.

- A popup showing all registration tasks for the client or fund account opens. Click the red X in the upper right corner to close the popup.

When viewing registration tasks, Fully Disclosed Brokers can also view supporting documents sent by a client and received by us.

To generate a PDF version of a client's account application

From the Client Account Details page, you can also generate a PDF of the client or fund account application.

- Log in to Account Management, and then click Manage Clients > Dashboard..

- Search or sort the account list to find the account of interest, and then click the account row to display the Client Account Details page for that client.

- At the bottom of the Client Account Details page, click the Generate Client PDF button.

A PDF file of the client application opens. You can print the application from the PDF.

To delete a pending client account application

You can delete any pending client or fund account application from the Client Account Details page for the pending account.

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Select Pending Applications from the Status drop-down. The list of accounts updates to display only pending client accounts.

- Click the desired account row to display the Client Account Details page.

- Click the Delete Application button at the bottom of the page to open the application.

- If you are sure you want to delete the account, click Submit.

- If you change your mind and do not want to delete the application, click Back.

To approve or reject pending client applications and client options trading permissions (Brokers only)

Fully Disclosed Brokers can approve or reject pending client applications and pending client options trading permissions if they have enabled Client Approvals. Use the Manage Clients > Settings > Client Approvals page in Account Management to enable or disable the approval of all client applications and options trading permissions for all clients. If you enable approval, all client applications and all client requests for options trading permissions must be approved by you before they are submitted to us.

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Search or sort the account list to find the account of interest, and then click the account row to display the Client Account Details page for that client.

- Click the Accept or Reject Application button at the bottom of the page.

- In the popup window that opens, select Yes or No from the Approve drop-down, add an optional comment, and then click Submit.

Note: For more information about client approvals, see Broker Client Approvals in the Account Management Users' Guide.

To view application and options trading approvals for all accounts (Brokers only)

Fully Disclosed Brokers can view application and options trading approvals in the Approvals column on the Dashboard if they have enabled Client Approvals. Use the Manage Clients > Settings > Client Approvals page in Account Management to enable or disable the approval of all client applications and options trading permissions for all clients. If you enable approval, all client applications and all client requests for options trading permissions must be approved by you before they are submitted to us.

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Approvals are marked with a small green check mark and show the username of the approver and the date of the approval.

- Rejected applications and option trading requests are marked with a small red X along with the username of the rejecter and the date of rejection.

Note: For more information about client approvals, see Broker Client Approvals in the Account Management Users' Guide.

To see which user deleted a client account application (Brokers only)

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Select Deleted Applications from the Status drop-down. The list of accounts updates to display only deleted client applications.

- Look at the Approval Status column to see the username of the person who deleted the application and the date on which the application was deleted.

Note: You can also click the desired account row to open the Client Account Details page for the deleted account, where you can view the same information.

To view pending items for all client accounts (Advisors only)

- Log in to Account Management, and then click Manage Clients > Dashboard.

- Search or sort the account list to find the account of interest, and then click the account row to display the Client Account Details page.

- Click the Pending Items tab to view all pending items for the account.

© 2016 Interactive Brokers